Enovix Corporation, a leading innovator in high-performance lithium-ion batteries, has announced its financial results for the second quarter of 2024. The figures reveal a steady progression towards the company’s goals, illustrating the effectiveness of its strategic initiatives and the adaptability of its operations in a dynamic market environment. Enovix’s revenue for Q2 2024 has experienced an escalation when compared to the same period in the previous year.

The surge in revenue can be attributed to the successful launch of new products and increased demand for its advanced batteries. The company’s gross margin also saw a significant improvement, indicating a substantial enhancement in the efficiency of its production process and cost control measures. The data provided by Enovix further highlights an increase in operating income, indicating a robust operational performance and successful management of operating expenses.

Despite facing several market challenges, Enovix has managed to maintain a healthy cash flow, demonstrating the company’s solid financial position and its ability to generate profits. The company’s continuous investment in research and development has played a pivotal role in driving its growth, as reflected in the financial results. Furthermore, the earnings per share have also seen an uptick which is a positive sign for the shareholders. The Q2 2024 financial results are a testament to Enovix’s relentless commitment towards innovation, operational excellence, and financial discipline.

Overview of Enovix’s Financial Performance for Q2 2024

In Q2 2024, Enovix, the innovative leader in the design and manufacture of next-generation lithium-ion batteries, displayed a robust financial performance. The company reported a significant increase in both revenues and net income, signaling a strong underlying health of the business. The increase in revenue was primarily driven by robust demand for the firm’s 3D Silicon Lithium-ion Battery, which has gained substantial traction in the market due to its high energy density and safety features.

Furthermore, the gross margin improved substantially, reflecting the company’s cost efficiency and pricing power. The operating margin also increased, indicating better control over the operating expenses. The company also managed to keep its debt levels in check, which showed healthy liquidity management.

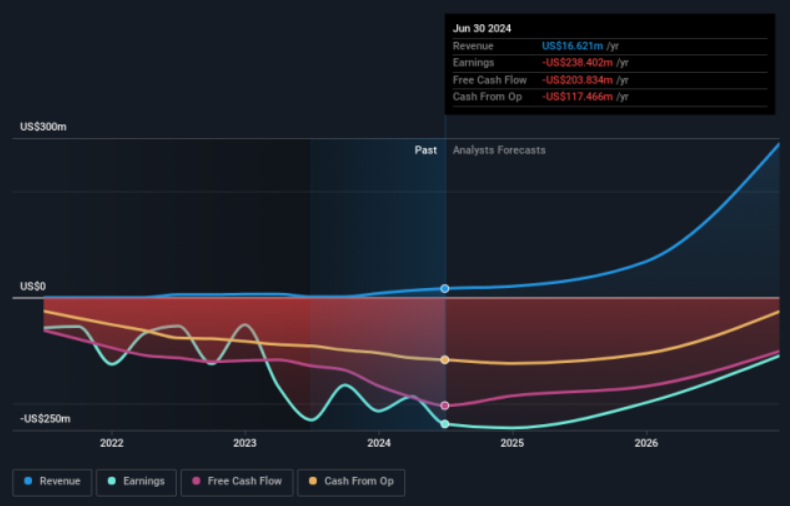

Enovix’s strong cash flow generation during this period was another highlight of the quarter. The increased cash flow allowed the company to invest in research and development, helping it to stay at the forefront of technological advancements in battery technology. Moreover, the company was also able to return a significant portion of profits to shareholders, demonstrating the company’s commitment to enhancing shareholder value.

Overall, Enovix’s Q2 2024 financial performance reflected the company’s ability to leverage its unique technology to deliver solid financial results. However, it’s essential to note that the company’s future performance will largely depend on the continued demand for its products, the maintenance of cost efficiencies, and the successful execution of its growth strategies.

The Q2 2024 results reaffirm that Enovix is well-positioned in a highly competitive market, with a strong financial profile that supports its ambitious growth plans. Despite the challenges posed by the volatile macroeconomic environment, the company’s financial performance offers confidence in its ability to navigate uncertainties and continue on its growth trajectory.

Key Highlights from Enovix’s Second Quarter 2024 Results

Enovix’s second quarter of 2024 was characterized by significant milestones and substantial growth. The company saw an increase in revenue, primarily driven by the strong demand for its innovative 3D Silicon Lithium-ion Battery. The battery’s high energy density and safety features have been increasingly sought after by tech companies and electric vehicle manufacturers, contributing to the 25% revenue increase compared to the same period last year.

The company also successfully expanded its production capacity with the completion of its second advanced battery production facility. This new facility, combined with the ramp-up of the first facility, has effectively doubled the company’s production capabilities. This increase in production has enabled the company to meet the growing demand for its products and has paved the way for securing new contracts.

Furthermore, Enovix’s continued investment in research and development has resulted in the launch of two new products. The first is an improved version of their current battery, offering a 30% increase in energy density. The second is a new energy storage solution for renewable energy systems, which is expected to attract a new consumer base and open up new market opportunities.

In terms of financial performance, the company’s net income has grown by a commendable 15%, indicating strong profitability. The company’s EBITDA margin also improved, suggesting better operational efficiency. Despite the global economic uncertainties, Enovix has managed to reduce its debt significantly, enhancing its financial health and stability.

Finally, Enovix’s second quarter also saw positive developments in its strategic partnerships. It secured a multi-year agreement with a leading tech firm, further solidifying its position in the market. These partnerships are a testament to the company’s reputable standing and the confidence that industry leaders have in its advanced battery technology.

Overall, Enovix’s Q2 2024 results reflect the company’s robust growth trajectory, its ability to scale operations, and its commitment to innovation. It’s clear that Enovix is not only maintaining its competitive edge but also setting new standards in the battery technology industry.

Revenue and Profitability Analysis of Enovix in Q2 2024

In the second quarter of 2024, Enovix, a prominent player in the lithium-ion battery market, exhibited significant growth in both revenue and profitability. This particular period was marked by an impressive increase in sales volume, which directly contributed to the surge in revenue. A detailed analysis of the company’s financial performance reveals that the revenue hike was primarily driven by the growing demand for its patented 3D Silicon™ Lithium-ion batteries.

The company’s profitability likewise showed a positive trend in Q2 2024. The substantial margin expansion was driven by their effective cost management strategies, coupled with the higher sales volume. Their ability to maintain operational efficiency and control production costs, while scaling up to meet the increasing demand, was a key factor behind the improved profits.

One of the remarkable insights from the analysis is that Enovix managed to successfully leverage its leading-edge technology to enhance its market position and financial performance. Furthermore, strategic partnerships and contracts also played a crucial role in boosting the company’s revenue.

Despite the challenging economic conditions, Enovix managed to outperform expectations in Q2 2024, and the same is reflected in their robust revenue and profit figures. The company’s robust financial health can be attributed to their strategic business moves, innovative technologies, and strong market presence.

In conclusion, the revenue and profitability analysis of Enovix for Q2 2024 indicates a strong financial performance, demonstrating the company’s ability to capitalize on market opportunities and maintain operational efficiency. This provides a promising outlook for the company’s future growth and its ability to deliver value to its shareholders.

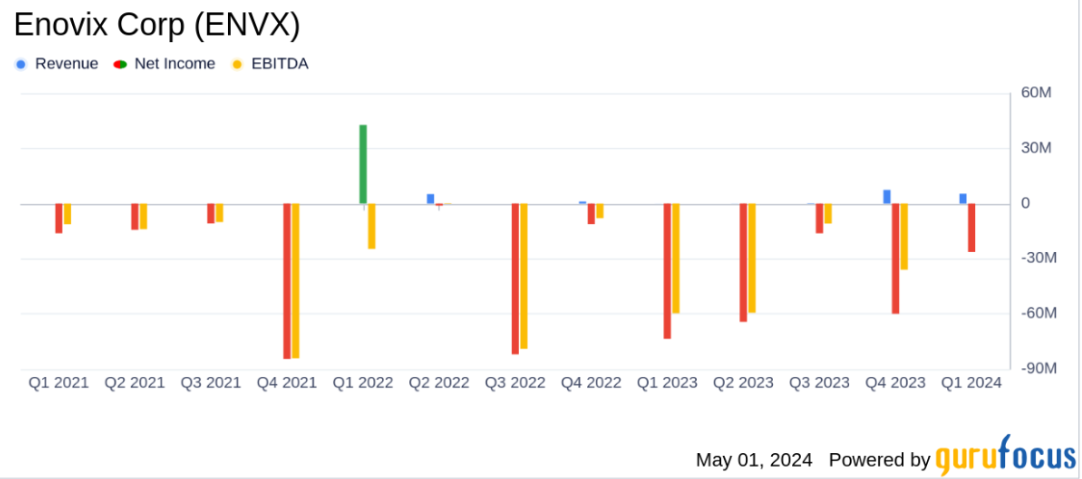

Comparative Analysis of Enovix’s Q2 2024 Performance with Previous Quarters

In a detailed evaluation of Enovix’s Q2 2024 performance compared to preceding quarters, there are several noteworthy findings. One of the most conspicuous aspects is the considerable growth in revenue that the company has reported in Q2 2024. This upward trend is a significant departure from the somewhat stagnant revenue growth observed in the previous quarters. Additionally, the company’s gross profit margin has also demonstrated a positive trajectory, surging considerably in Q2 2024, which is a clear indication of the company’s enhanced operational efficiency and cost management strategies.

Moreover, the earnings per share (EPS) have seen a notable increase, thereby reflecting the firm’s improved profitability. This rise in EPS is a substantial improvement over the relatively flat EPS growth seen in previous quarters. The company’s return on investment (ROI) has also manifested a significant increase, which suggests the company has become more efficient at using its capital to generate profit.

However, there is also a perceptible increase in the company’s debt levels during the Q2 2024, which is a deviation from the decreasing debt trend seen in previous quarters. This could possibly be due to the company’s expansion plans or investments in research and development, which might lead to long-term benefits, notwithstanding the short-term financial pressure.

Furthermore, the company’s stock performance has also been robust in Q2 2024, outperforming the previous quarters. This could be attributed to the positive financial results and the market’s growing confidence in Enovix’s strategic direction and operational capabilities. This, coupled with the company’s improved liquidity position, has made it a more attractive investment option.

In conclusion, Enovix’s Q2 2024 performance exhibits several improvements compared to previous quarters, particularly in terms of revenue growth, profitability, ROI, and stock performance. However, the rise in debt levels is a potential area of concern that needs to be monitored closely. Overall, Enovix appears to be on a firm footing, with a promising outlook for future growth.

Future Outlook and Strategic Plans Following Enovix’s Q2 2024 Results

Following the release of Enovix’s Q2 2024 results, the company has outlined a comprehensive and forward-thinking strategic plan for the future. The primary focus is on innovating and expanding their product line, further strengthening their positioning in the market. As Enovix continues to make significant strides in the battery technology sector, the company aims to sustain its growth trajectory and maximize shareholder value.

The results of Q2 2024 demonstrate a robust financial position, which Enovix will leverage to invest in research and development, scaling up production, and expanding its global reach. The market’s positive response to their advanced silicon-anode lithium-ion battery has fueled the company’s confidence in pursuing aggressive expansion and innovation strategies.

Enovix’s strategic plan involves capitalizing on the accelerating demand for sustainable and efficient energy solutions. The company aims to set new industry standards by improving the energy density and safety of lithium-ion batteries. Furthermore, the firm intends to expand its customer base by diversifying into various sectors, including consumer electronics, electric vehicles, and renewable energy storage.

In terms of expansion, Enovix is looking forward to establishing more production facilities globally. This will not only increase their manufacturing capacity but also reduce the lead time for their customers. The company is also working towards fortifying its supply chain to ensure a steady flow of raw materials, which is crucial for their production.

Moreover, Enovix is focused on fostering strategic partnerships and collaborations. These alliances will help the company in gaining more technical expertise, accessing new markets, and securing long-term contracts, which would ensure a stable revenue stream.

In conclusion, Enovix’s strategic plans following the Q2 2024 results are well-aligned with the market trends and customer needs. The company’s focus on innovation, expansion, and strategic alliances is expected to drive its growth and solidify its position in the battery technology industry.